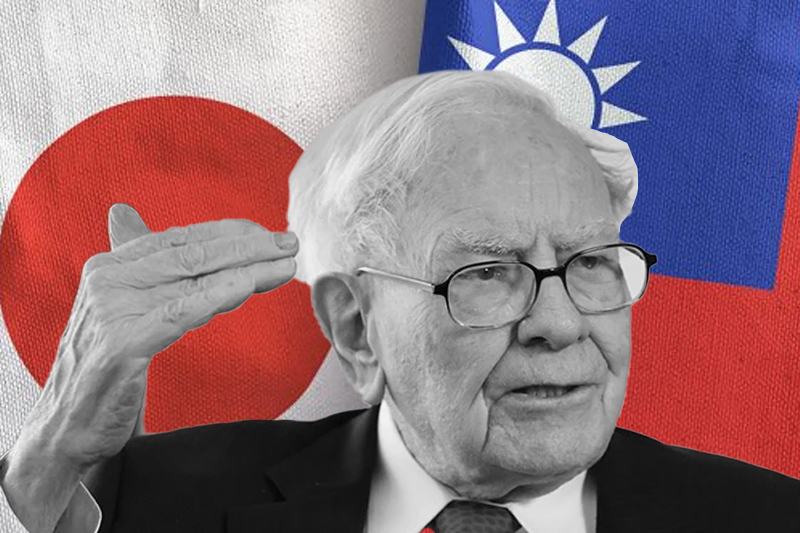

Buffett Likes Japan Better Than Taiwan

Berkshire Hathaway CEO Warren Buffett recently explained why Japan is a better investment than Taiwan. His investment ideas are respected as one of the most successful investors ever. We’ll discuss why Buffett prefers Japan over Taiwan and how geopolitics affects his investments in this post. We’ll discuss other factors smart investors should consider when investing. Read on to learn how Buffett’s ideas could change your investing, whether you’re a beginner or a pro.

Warren Buffett on investing in Japan

Warren Buffett is famous for his disciplined and smart investing. He thinks Japan’s economy and business are promising. Berkshire Hathaway invested over $6 billion in five large Japanese trading companies.

Buffett says investors like Japan because its companies are well-run and have good management. Japanese companies have a lot of cash they can use for growth or dividends or buybacks.

As demand rises, Buffett says Japan’s aging population could create new healthcare and other investment opportunities. Because the country prioritizes innovation and technology, emerging market investors have many options.

Buffet believes smart investments can solve Japan’s problems, such as slow economic growth and deflation. His famous quote: “Our favorite holding period is forever.”

Keep Reading

Why he prefers investing in Japan over Taiwan?

Financial experts have noticed Warren Buffett’s recent investment shift to Japan. He is often asked why he prefers investing in Japan over Taiwan. It’s partly because Japan’s government is more stable than Taiwan’s.

Due to its stable society, strong economy, and innovative technology, Japan has long been a safe investment. Toyota, Sony, and Nintendo are headquartered there. These firms shaped the global economy.

However, Taiwan’s issues with China make investing difficult. Taiwan’s export-dependent economy is also vulnerable to global market changes.

Buffett also thinks Japan’s aging population could benefit senior care companies. Population growth may increase demand for medical products.

Buffett also likes how Japanese companies use renewable energy like solar and wind turbines. Asia’s leader in Japan.

Warren Buffett values stability and new ideas, which is why he invested more in Japan than in Taiwan.

World conditions and investing

Geopolitics studies how political events and decisions affect global relations. Geopolitics is crucial when choosing where to invest and where not to. Political unrest, trade tensions, economic sanctions, and military conflicts can all hurt investing.

World events can affect investments, so investors must stay informed. Investors can capitalize on opportunities and reduce risks by following geopolitical news.

To reduce geopolitical risk, diversify across regions and asset classes. If you invest in one country or region, you could lose a lot if something unexpected happens.

In today’s global economy, long-term investors must understand geopolitics. Because small global changes can have big effects on our portfolios, it takes a lot of research and analysis.

Other investment considerations?

Because of global politics, Warren Buffett prefers Japan over Taiwan. Japan has a better chance of long-term growth and stability.

However, geopolitics is only one consideration when investing. Investors should consider a company’s fundamentals, industry trends, competitive landscape, management team, financial metrics, and valuation.

Investing well requires a comprehensive plan that considers many factors and the big picture. Investors can use accurate data to maximize returns and minimize risks.