How the Real Estate investment flows fully enter the arsenal of geopolitical dynamics

The coronavirus pandemic has brought the entire global economy to its knees. Following the COVID-19 emergency, the key to the recovery seems to be that of sustainability and improving the healthiness of the spaces in which we live. The ability of countries to assume a front-runner role on these issues will be an important safeguard of international competitiveness as well as resilience towards future possible health emergencies. A challenge that is not only economic but can also translate into a geopolitical competition.

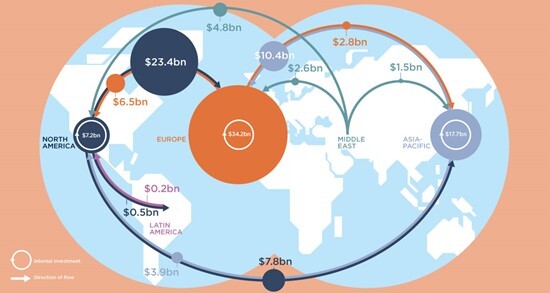

With $ 1.8 trillion invested around the world, 2018 was the busiest year in the global real estate market in decades. The figure includes cross-border capital flowing from one continent to another connecting not only investors but also different national economies. In 2009, the implosion of sub-prime mortgages that originated in the United States and the global financial crisis that followed allowed a better appreciation of the geopolitical impact and externalities of the real estate sector on the global economy. Investors have rediscovered that globalization in the real estate sector as in other sectors involves, in the face of mutual benefits, also interdependencies, and contagions of vulnerability between economies and states.

As stated in the document Globalization of a commercial property market: the case of Copenhagen, the globalization of the real estate sector is driven by various actors, private or public, who are involved “in the production, ownership, maintenance, use and reproduction of the built environment in the market at ever-increasing distances”. It means that there can be thousands of kilometers between those who live or work in a building, the bank that provides financing to those who buy the building, the asset management companies that manage the assets, and capital contributing investors.

The opening of the real estate market to foreign capital is fuelled mainly, but not exclusively, by profit and by the diversification of risk. However, the size of capital to be allocated in one country rather than another may vary according to other purposes (beyond the profit) that political economy should take into consideration. Recent research has investigated the implication that capital outbound invested in real estate has on geopolitics, suggesting that “geopolitics not only affects but is also conditioned by the production and circulation of real estate capital”. Given its international and cross-border characteristics as an investment product, Real Estate is considered a case of the geopolitics of the multiple – a theory according to which, in the era of globalization, geopolitical strategies are “assembled” by the continuous change of actors, motivations and heterogeneous materiality that influence the ways and purposes with which foreign relations are negotiated today.

In Russia, real estate emerged as a marketable commodity in the early 1990s, as a result of the transition from socialism to capitalism that allowed the privatization of the sector and the transfer of state-owned titles to tenants. This process allowed Russian investors to start investing in the domestic and foreign market by creating a network of economic relations that still influence international politics today. In 2019, Russia was still the second outbound direct foreign investor, after China, among emerging economies.

Since the outbreak of the civil war in Syria, many cities have been subject to bombing. In 2019, the cost of rebuilding Syrian cities was estimated at between $ 260 and $ 400 billion. Syrian law currently does not allow foreign nationals to own or purchase real estate. However, the government has shown itself to be open to some exceptions, and even if the war is not over yet, domestic and foreign players are already looking for investment opportunities.

The Syrian government has issued many decrees to organize and benefit from the reconstruction that will follow the war, promoting large real estate projects that should attract foreign investors. Several property laws, including the infamous Law 10 that allows the government to designate redevelopment zones and force landlords to surrender the property in exchange for compensation, are designed to open up lucrative real estate opportunities. The reconstruction program appears to be an attempt to attract political support internationally, but for the regime, this process is driven by two main purposes: to stimulate an otherwise unsustainable reconstruction with private funding and to do so in a way that channels economic returns to men and women. industries affiliated with the Syrian regime.

The attempt to attract foreign capital and to create international consensus, however, blurs the reasons for the internal political stability of the reconstruction program. The latter prevents many residents and refugees from asserting their legitimate property rights and creates a significant obstacle to the return of regime opponents.

Related Posts

Due to the pervasive nature of the real estate market, globalization has paved the way for interests that go beyond the simple economic value of Real Estate. Foreign investments in the sector are emerging in an unprecedented political and public key. Unlike other financial instruments, real estate finance has a more direct link with the real economy and can therefore have a more impact on cities and communities’ life. Real estate flows are today more than ever important vehicles of political hegemony. That’s why these dynamics fully enter the arsenal of geopolitical strategies.