EU Court Orders Apple to Repay €13bn in Landmark Tax Dispute

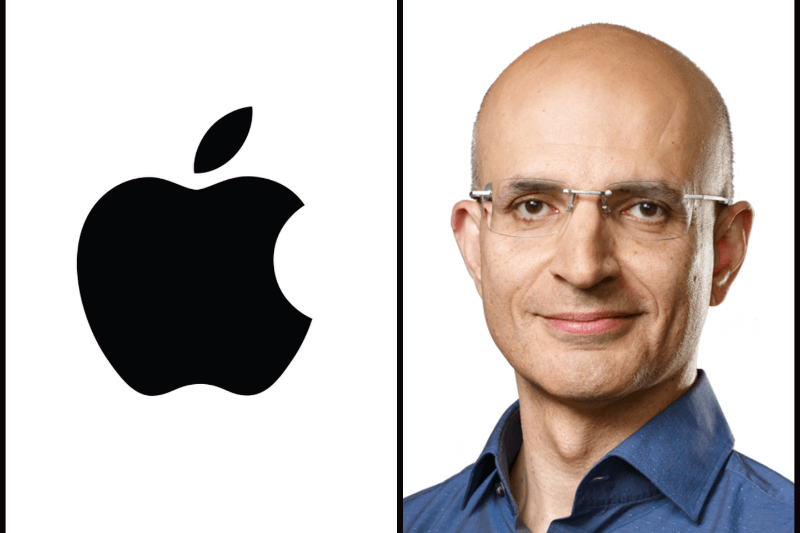

Apple has faced a major setback in a legal battle against the European Union over a €13bn tax bill. The European Court of Justice (ECJ) has ruled in favor of the European Commission and said that the Apple must repay the €13bn in tax breaks it received from Ireland. The ruling strengthens the stance of EU on cracking down on preferential tax arrangements for multinational corporations.

This is an ongoing case since 2016 when the European Commission determined that Ireland had granted Apple “illegal” state aid in the form of favorable tax treatments. The commission argued that this gave the tech giant Apple an unfair advantage. Since Apple was only paying an effective tax rate of 0.005% on profits generated outside the US. The ECJ decision overturns a 2020 ruling by the General Court, which had previously sided with Apple, saying the Commission failed to prove that Apple received selective tax benefits.

EU competition chief Margrethe Vestager hailed the ruling as a major victory in her efforts to challenge unfair tax deals given to major corporations like Apple, Amazon, and Fiat. The ruling is seen as a key moment in the EU’s broader push for tax fairness.

Apple is not satisfied with this decision, they showed their disappointment. They argued and said the company always maintains and pays the taxes.

The ruling also coincides with another significant ruling where Google lost its appeal against a €2.4bn antitrust fine. The ECJ upheld the European Commission’s fine and concluded that Google had unfairly given preferential treatment to its online shopping services compared to competitors.