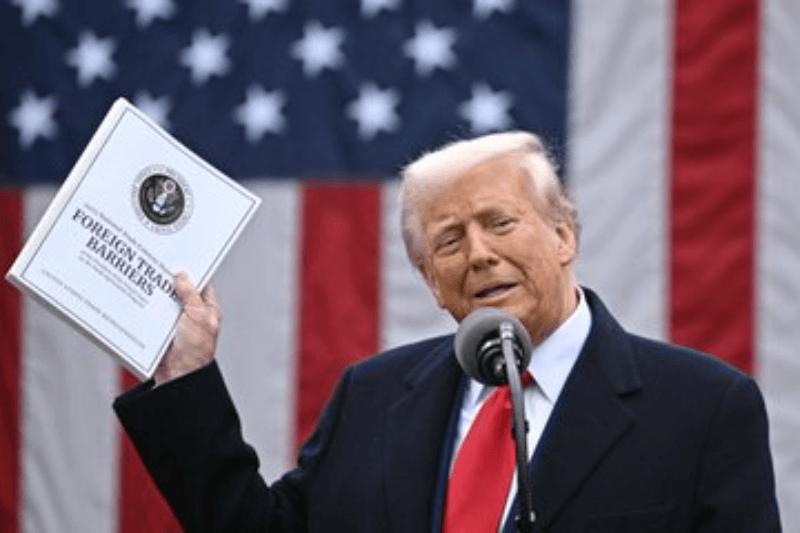

Trump’s Second Term Sees Investor Euphoria Fade as Markets Struggle

Financial markets indicate diminishing interest in President Donald Trump after his first complete month in his second presidential term. Financial market trends including stock indices and currency exchanges together with Bitcoin value show evidence of stabilizing because investors now doubt whether their first predictions will come true.

The S&P 500 shows trailing performance to European, Chinese and Mexican stock market indices. The dollar has let go most of its original strength and investors are now backing away from bets on increasing U.S. Treasury yields. The cryptocurrency market experienced a slowdown because investors worry about Trump’s economic policies especially his defensive tariffs.

Small-cap stocks did not achieve their anticipated surge because of Trump’s policies. The Russell 2000 managed a 5.8% ascent right after the election yet maintained a stagnant performance afterward. The increased rate of interest has become a heavy financial burden for small companies because they rely more substantially on debt. Energy and financial stocks demonstrated initial price gains after the election though only financials continue showing strength with a 12% increase because of sound bank performance. Renewable energy stocks exhibit signs of deterioration because Trump supports fossil fuels over green energy.

Transitions in Federal Reserve policy have managed to dissipate one of the Trump trade’s primary economic strategies which involved strengthening the U.S. dollar. The dollar lost its initial upward direction the same way as experts predicted bond yields and inflation rates would rise following tariffs. Some investors bought the Bloomberg Dollar Spot Index at a premium after the election yet it has decreased by 1.5% since January. The bond market expects stable debt issuance and budget cuts since the administration gave evident signals about these measures which led to declining long-term interest rates.