UAE–Senegal Trade and Investment: Ports, Energy, and Growth

The air around Dakar’s port is thick with salt and diesel. Cranes groan, trucks rattle over uneven ground, and dockworkers shout as containers swing into place. A good number of those containers trace back to the United Arab Emirates. In four years, imports leapt from $174 million in 2019 to $668.5 million in 2023.

These aren’t just statistics. They show up at fuel stations, where pumps stay stocked longer, and on construction sites where machines don’t sit idle waiting for parts. Many officials now describe the link as Senegal and UAE: Emerging Investment Partners in Africa & the Middle East.

Rising Trade Volumes Between UAE and Senegal

Hydrocarbons still top the list. Tankers unload gasoline and diesel that feed buses in Dakar and power generators in remote villages. Behind them come machines: tractors, spare parts, and industrial equipment. Each shipment feels less like luxury and more like necessity.

Importers point to reliability. Shipments from the UAE arrive on time more often than those from older partners. A contractor in Thiès no longer halts projects for weeks while waiting on spare parts. A farmer near Saint-Louis gets machinery repaired without missing an entire planting season. These examples explain the rise more than any chart.

Strategic Infrastructure Investments by the UAE

Trade is only as strong as the infrastructure that carries it. That’s why the UAE has invested in Senegal’s ports. DP World is building the Port of Ndayane, 60 kilometers from Dakar, with the promise of deeper berths and faster handling.

Anyone who has sat in Dakar traffic while trucks line up at the port knows how urgent this is. Congestion costs time and money. Phase one of Ndayane, with a budget over a billion dollars, is meant to break that choke point. Bigger vessels will dock, goods will move quicker, and Senegal may finally serve as a regional hub.

DP World already manages Dakar’s container terminal. With both facilities under its wing, the UAE gains a grip on Senegal’s maritime lifelines. For locals, the hope is simple: jobs created, bottlenecks eased, and smoother trade across West Africa.

Energy and Water Cooperation

Energy shortages remain a frustration in Senegal. Villages once lit by kerosene now glow under solar panels financed with Emirati money. At midday, panels shimmer in the heat, feeding electricity into homes, schools, and health posts. The difference is felt in the hum of fans and the buzz of lights after dark.

Water is another front. The UAE has partnered with Senegal on irrigation systems and treatment plants. Anyone who has faced a dry tap in Dakar during hot season knows the stakes. With new funding lined up, the goal is fewer shortages and safer supply. For Abu Dhabi, these projects show a long view: investment in essentials, not just headline infrastructure.

Diplomatic Engagements and Leadership Visits

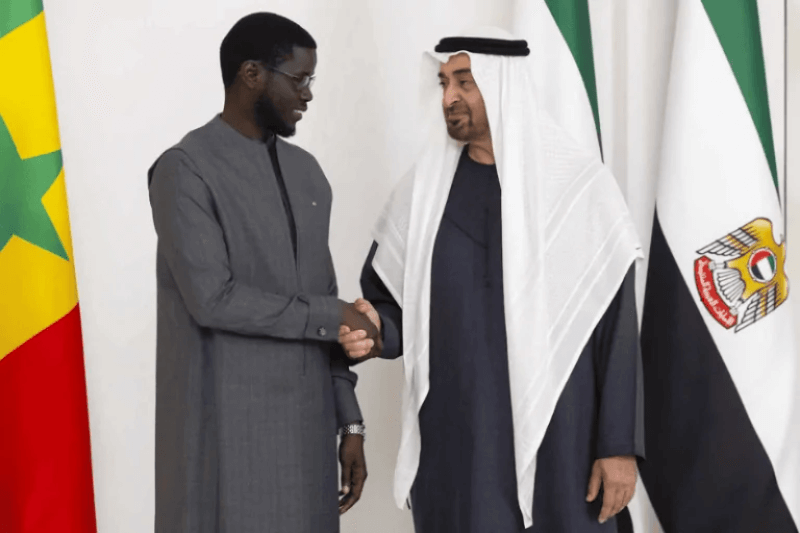

Deals like these do not appear out of thin air. They are built on diplomacy. Senegalese leaders travel to Abu Dhabi and Dubai, returning with signed memoranda that often turn into contracts. The most recent trip carried the tagline Dakar to Dubai: How the PM’s Visit Could Boost Trade.

These aren’t just photo opportunities. Leaders sit down, cut through slow-moving processes, and push projects forward. Emirati officials return the gesture, attending African investment forums and cultural events in Dakar. The regular pace of visits makes the relationship look steady, not improvised.

Education, Technology, and Human Capital Partnerships

Hard assets matter, but so do people. Scholarships now link Senegalese students to universities in Abu Dhabi. Families talk about children studying aviation, engineering, or IT abroad, skills they can bring home. Technical programs in Dakar train workers for logistics and energy projects funded by the UAE.

Technology pilots are underway as well. E-governance platforms and digital banking projects are tested with Emirati backing. For a city where paperwork has long slowed services, digital tools bring cautious optimism. Young entrepreneurs talk about Emirati investors in the same casual way they once talked about French backers.

Regional and Global Geopolitical Implications

The UAE’s role in Senegal plays into a wider contest. China keeps building roads and rail lines. Europe holds contracts in fishing and energy. The United States leans on defense partnerships. The UAE has chosen its spots: ports, renewables, logistics, education.

Senegal’s Atlantic coast makes it strategic. Whoever controls its ports shapes trade flows into West Africa. For the UAE, long concessions at Ndayane and Dakar secure a stake in that system. For Senegal, diversifying partners means less dependence on Europe or China. Yet there are questions. Fishermen near Ndayane wonder how dredging will affect their catch. Environmental groups warn about coastline change. Growth carries weight, and locals feel it most.

What’s Next for UAE–Senegal Relations?

Looking forward, the corridor is expected to grow. More flights are likely to connect Dakar with Dubai. Emirati investors are already eyeing Senegal’s beaches and heritage sites for tourism projects. Financial services may follow, with special economic zones under discussion to speed customs and attract foreign firms.

Digital services stand out as a new area. With mobile banking already spreading, UAE firms see openings in payment systems and online infrastructure. For Senegal, that means jobs in IT and service industries beyond farming and construction.

What began with oil shipments now stretches into ports, solar farms, scholarships, and banking. The partnership has layers: trade, infrastructure, education, and daily essentials. Each year, the link grows tighter. For Senegal, the gains must translate into steady jobs and reliable services. For the UAE, the reward is influence and a stable bridge into West Africa.