Tariffs, Tensions, and Tumbling Stocks: What Comes Next?

Markets had another bumpy ride on Tuesday as investors braced for the Trump administration’s latest round of tariffs to kick in at midnight. What began as a hopeful morning rally quickly faded, ending in losses for the fourth day in a row.

The big question on everyone’s mind: How will these tariffs affect everyday prices — from groceries to gadgets?

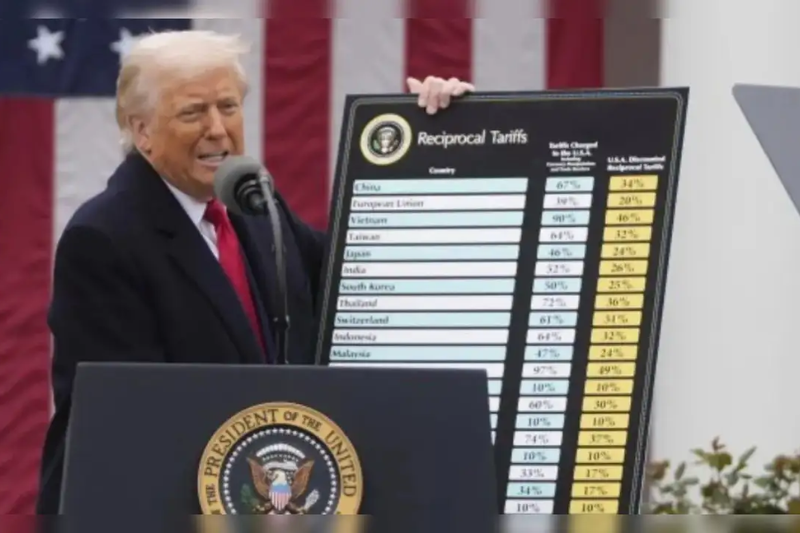

The uncertainty is growing. The U.S. has imposed steep new tariffs on goods from several countries, especially China, and both sides have ramped up tough talk. China has now been hit with tariffs totaling over 100%, and they’ve promised to “fight to the end.”

This tension is making Wall Street nervous. The S&P 500 swung wildly during the day, ending down 1.6%. The Nasdaq dropped by 2.2%, and the Dow fell 0.8%. Since the start of Trump’s second term, the S&P is down 17% and the Nasdaq has lost 22%.

Even with hints from Trump and Treasury Secretary Scott Bessent about possible “deals,” economists warn that businesses are likely to slow down. A report from BCA Research said we could soon see companies cutting profit forecasts and reducing hiring or expansion plans.

Earlier in the day, Trump claimed that China “wants to make a deal badly.” But China called the latest tariff threat “blackmail” and said they won’t back down.

Treasury Secretary Bessent responded that China was making a mistake by escalating the conflict. While he left the door open for individual country deals, he also said some tariffs would likely stay.

Trump’s broader goal is to bring manufacturing back to the U.S. He wants everything from cars to electronics made domestically — but critics say it’s not that simple.

His advisor, Peter Navarro, even singled out Tesla, saying that parts of their cars still come from Japan and China. “We want engines made in Flint, tires in Akron, and cars built here,” Navarro said.

But many business leaders and economists think this strategy could backfire. Prices for everyday items could rise sharply. Hedge fund manager Ken Griffin warned this week that tariffs could make basic goods like toasters, groceries, and cars up to 40% more expensive.

“It’s a 20-year dream,” Griffin said. “Not something that happens in two years.”

In the meantime, small businesses are also feeling uneasy. A new report from the National Federation of Independent Business showed the biggest drop in small business confidence since 2020.

And while there was a brief rally on Tuesday, experts say that could just be temporary. Goldman Sachs warned that in tough markets, short bursts of optimism are common — but not always reliable.

With earnings season starting this week, everyone will be watching how companies react to the ongoing trade war. But with so much still up in the air, clear answers might be hard to come by.

As market strategist Steve Sosnick put it: “People are confused, scared, and angry.”