The New Silk Road: How China’s Belt and Road Initiative Shapes the Future

The Belt and Road Initiative (BRI) of China, which started in 2013, has turned into the New Silk Road. It has been able to link around 150 countries during this period with huge infrastructure developments that have and will cost a total of $1.308 trillion by mid-2025. The first half of 2025 was quite a record-breaking period for BRI involvement as it accounted for $66.2 billion in construction contracts and $57.1 billion in the total investment, which was mainly directed at the sectors of energy, mining, and hi-tech manufacturing. This unprecedented network has the ability to reduce the cost of trade, increase the number of connections, and contribute to the process of economic integration, all the while causing the problems of debt sustainability and geopolitics to be the main concerns. The paper that follows will analyze the BRI’s that has changed trade, development, and the world power very drastically.

BRI’s Economic Engine and Scale

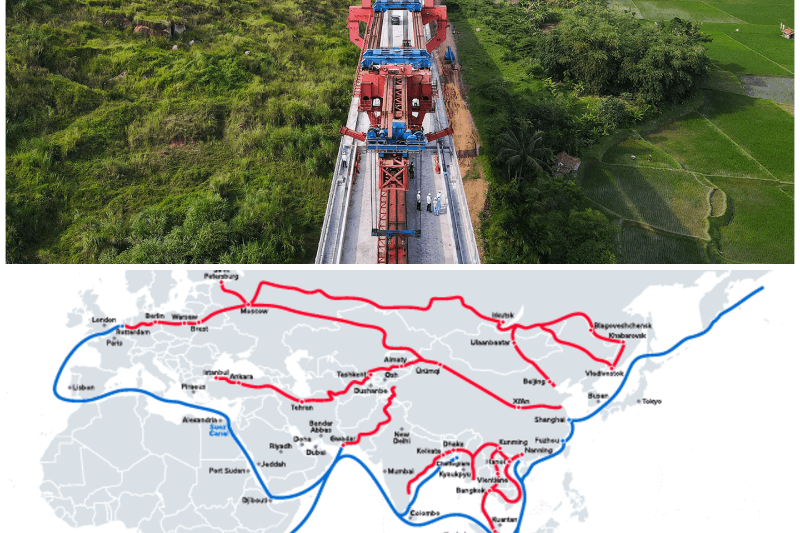

The BRI’s geographical range includes roads, ports, railways, and digital infrastructure, which have all decreased the time needed for transportation and have fostered the gathering of economies in the manufacturing hubs. There was a great increase of $44 billion in energy involvement during the first half of 2025, where renewables played a role of $9.7 billion – leading the solar, EV batteries and hydrogen – while oil/gas took the $30 billion. Africa ($39 billion) and Central Asia ($25 billion) were the main areas receiving funds, which helped local industries to develop and markets to integrate.

Global Trade and Development Impacts

According to the program, world income will be raised by 0.7% in 2030, thus facilitating the access of millions to the poverty-free zone as a result of the trade that will cover 75% of the world population and more than half of the GDP. Urbanization in the countries participating in the BRI will be accelerated along with the upgrade of infrastructure leading to the growth of the urban population driven by innovation. Nevertheless, the critics have pointed at the debt traps and the environmental risks. However, the recent changes have been turning away from the past, and the focus has been on the “green, high-quality” projects.

Geopolitical Shifts and Challenges

BRI shifts value chains and increases China’s grip with the US in the background, while investing through private companies like East Hope Group. The main challenges are geopolitical split, fluctuations in commodity prices, and sanctions but the partnership with the multilateral banks still provides some strength against the risks. Working out debts and introducing ESG norms are vital to the long-term survival of the business.

Future Trajectory

If BRI adopts free trade and focuses on renewables and digital Silk Roads for inclusive growth, the trade gains could be doubled by 2030. Its choice of adaptation will tell if it becomes a factor of multipolar prosperity or of deepening divides.