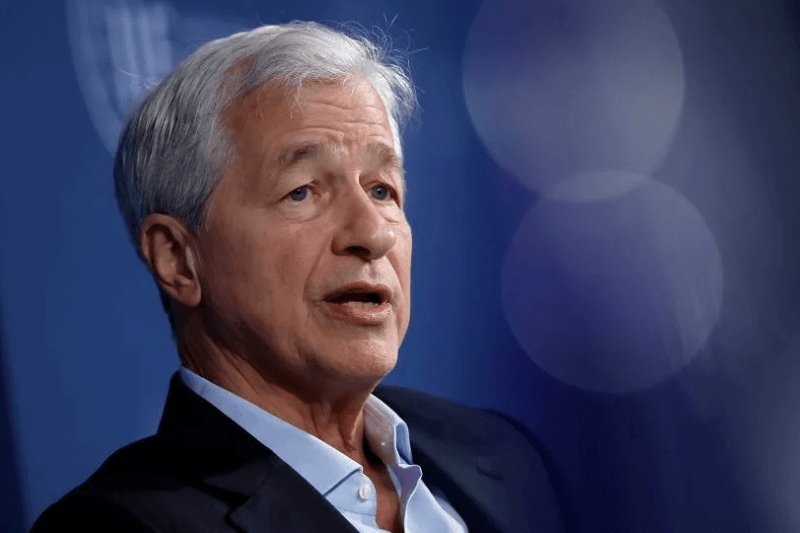

Dimon Warns Trump’s Tariffs Could Trigger Recession and Weaken America’s Global Standing

JPMorgan Chase CEO Jamie Dimon strongly warns about the negative outcome of President Donald Trump’s tariff choices. The head of JPMorgan J. P. Dimon stated in a letter to shareholders that business tariffs might spark higher prices and damage worldwide economic performance.

In his shareholder letter, Dimon informed readers that tariffs will worsen inflation rates and that many people now expect a recession to happen. He understood evidence shows that rising tariffs might not create a recession but stated clearly that they will reduce economic momentum.

Through his statements Dimon demonstrated his belief that Trump’s focus on US national interests would weaken America’s worldwide leadership placement. He stressed that the America First approach works as long as it keeps American forces coordinated with international partners.

The JPMorgan CEO explained the essential connection between security and economics by saying economic wars have created military wars in past history. He now takes a different approach after earlier stating that Americans should tolerate minor inflation to support US manufacturing. Dimon believed stock market depression would continue even though US stock values had dropped

The current market levels appear stable although they have downtrended:

- The market made its transformation from its peak position to the edge of bear territory within seven weeks.

- This markdown stands as the second fastest transformation from market top to low point throughout market history.

He described the modern world as the biggest international threat to peace since World War II yet still expected safe growth from our economy.